Essence of Fundamental Analysis

A cornerstone of the evaluation of the intrinsic value of stocks, fundamental analysis is based on various data concerning a company’s earnings, expenses, as well as assets and liabilities. This approach allows investors to decide whether a stock must be bought, held, or sold as it offers a tool of assessing the fair value of stocks. The present paper elaborates on the role of financial statements in a fundamental analysis, factors influencing the discipline, and specific illustrations from the field.

The Role of Financial Statements

At the core of fundamental analysis are the financial statements of a firm. As for Apple Inc., its revenue reported in 2022 was nearly $394 billion, which is approximately 8% above the previous year . The data is essential to reflect the state of a company and its perspectives.

Economic Indicators and Their Role

Another vital aspect of the analyzed framework is economic indicators that can also affect decisions. For instance, the rate of unemployment in the U.S. was reported to be 3.7% in September 2023 . This will decrease the funds that customers spend and the profits of firms, impacting stocks.

Case Study: Examples of Successful Fundamental Analysis

Amazon’s extension into the area of cloud computing is a vivid example of a successful fundamental analysis. Initially, the revenues of its AWS were modest, while in Q3 in 2023, it was over $21 billion, which constituted around 16% of Amazon’s total revenue . As a result, the value of the firm on the stock market also significantly increased.

Comparative Analysis with Competitors

Alternatively, one could also compare the situation with other firms. For example, Pepsi and Coca-Cola can be compared using data about market shares and profits. The former’s revenue in 2022 grew by 10%, while the latter’s increase was 7% .

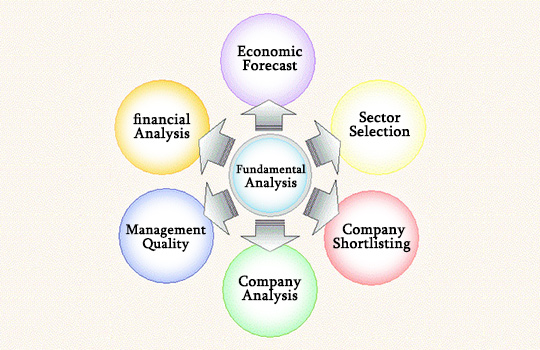

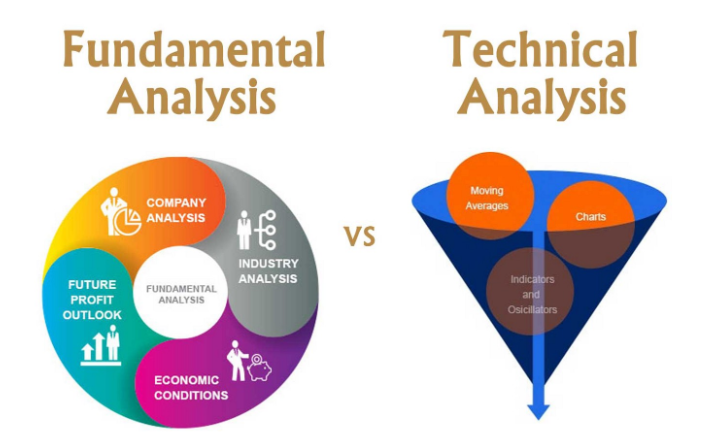

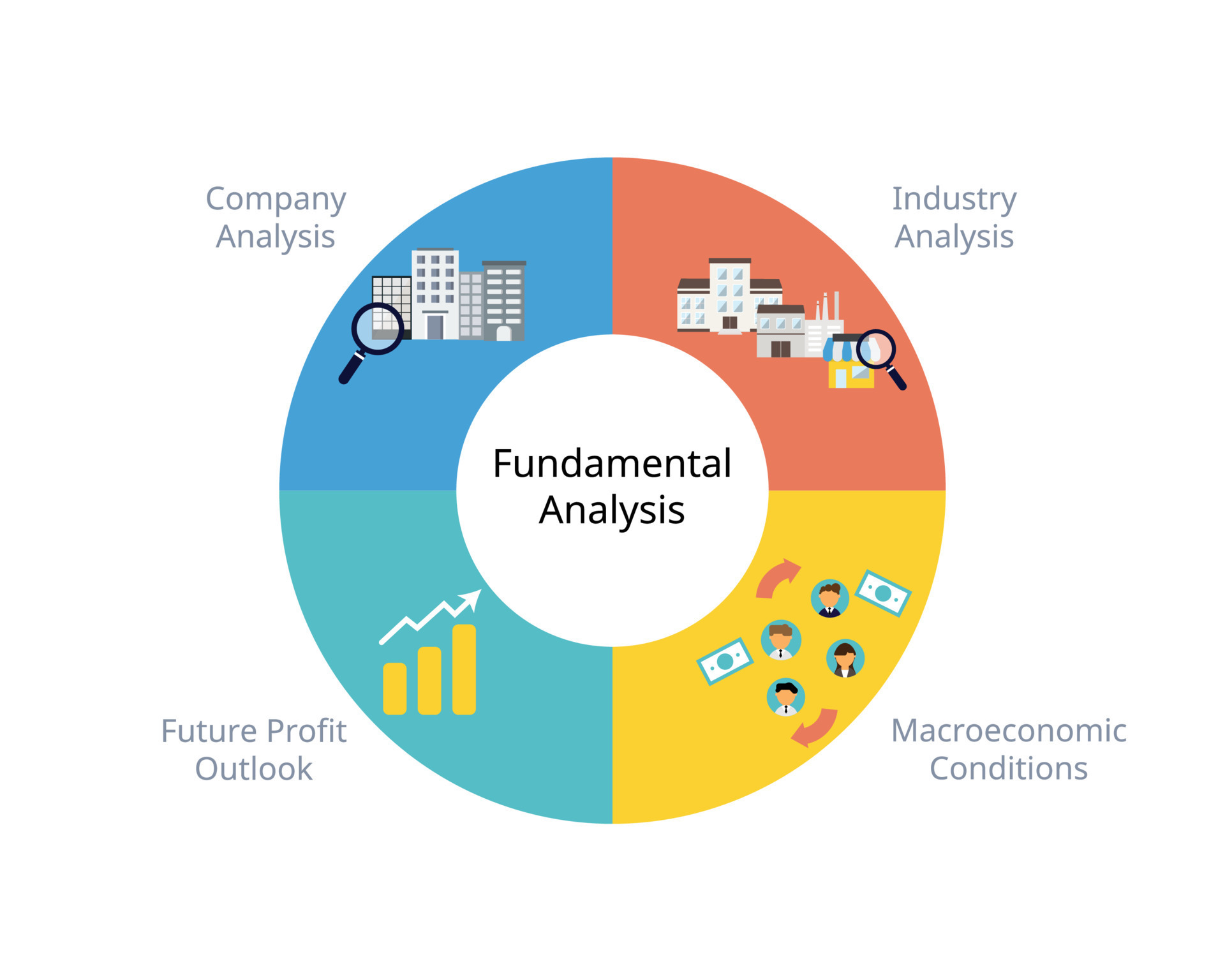

Types and Processes of Analysis

Fundamental analysis is regarded as being vital in the estimation of a stock’s intrinsic value or any other type of financial asset. As such, understanding the various types and details of the process in question is instrumental in focusing on the ways to analyze a company’s financial statements, the indicators of the economy and the condition of the industry. Being quite thorough and exhaustive, the method of fundamental analysis seems to be highly beneficial when attempting to evaluate both business’s current condition and possible potential. In the sphere of fundamental analysis, there are qualitative and quantitative analyses as well as the other analytical tools.

Scope of Qualitative and Quantitative Analysis

Qualitative analysis implies the assessment of factors that do not necessarily enjoy a straightforward presentation in terms of numbers, including the quality of management, the recognition of the brand and the availability of patents. Meanwhile, quantitative analysis implies the analysis of numbers recorded in the financial statements, such as income and retained earnings, as well as balance and cash flow sheets. For instance, P/E, or Price to Earnings ratio, is a common tool that could be used for the purpose of estimating the significance of a stock, with the recorded ratio attributed to Apple in its 2021 fiscal year being approximately 28. Hence, if the stock had been overpriced as opposed to industry standards in this regard, the investors could adjust their position accordingly.

Top-Down and Bottom-Up Analysis

Top-down analysis implies that the analysis of the GDP growth rate and other macroeconomic factors is swiveled to analysis sectors and then companies. For example, when analyzing the sector of renewable energy, the corresponding example might start with scrutinizing the energy consumption trends on the global scale to focus on a company such as Tesla once the information is obtained. Quantitatively, bottom-up analysis is focused on company-specific data first, such as clinical operation with no inclination to consider the larger political or social context right away.

Core Data Sets in Fundamental Analysis

Many core data sets are the cornerstone of fundamental analysis. They provide both the quantitative and the qualitative parameters that help make informed decisions. The advantage of fundamental analysis is that it is based on substantive evidence and may link several spheres. In other words, the data, as in the presented article, usually relate to aspects related to the company and outside of it – such as macro and microeconomic values.

Financial Statements as the Basis

The first, most used, and commonly accepted data set by investors and analysts is the financial statement of company performance indicators. This may include an income statement, a balance sheet, and a cash flow statement. For instance, the net income reported by Apple Inc. in the income statement and amounted to almost $100 billion. The analytical possibilities of these statements help by assessing revenue, profit sources, volumes, the share of borrowed capital in the capital structure, and general cash flows.

Economic Parameters Impact

The performance of a company lies in a particular economic and social situation, and therefore indicators relate to it as well. They are, first of all, GDP growth rates, inflation and unemployment rates, the consumer confidence index. For instance, GDP growth is often associated with an increase in consumer spending, and this seems to affect the number of consumer electronics products sold worldwide and, correspondingly, the Apple Inc. revenues.

Market Data

The market price of the asset analyzed – shares, as well as transaction volume and the price history on the market. Such data help assess market reaction and expectations of its future performance. This data set is needed to construct an idea of market sentiment.

Industry Metrics

Special data specifically concentrated in the industry. It may be market size, television content segment growth rates, and the average revenue per user in the telecommunications market. According to such an approach, an evaluation is made relative to other industry members.

Approaches to Fundamental Analysis

Fundamental analysis is a comprehensive approach to assessing an investment’s real value, focused on whether a stock is overvalued, undervalued, or correctly valued. There are various strategic approaches to the technique, all aimed at determining investment opportunities and a financial perspective for a corresponding company.

The Quantitative Method

The strategy implies the use of quantitative data, specifically, company financial records and calculations. Among the metrics used are the P/E ratio, Debt-to-Equity ratio, Return on Equity, and others. A low P/E ratio, for example, might indicate that company’s stock is undervalued, especially if it is much lower than the historical P/E and when compared to other companies in the industry . The method of comparison was used to analyze Microsoft in 2020 when the company’s P/E average was seven times higher than the industry’s, hinting at overvaluation.

The Qualitative Method

The qualitative approach uses other factors besides quantitative data to analyze a potential investment, including brand strength, patents, or simply, management. In a premier real-world example seen above, Steve Jobs’ return to Apple in 1997 is a qualitative, psychological factor which indicates that he would overturn the ailing company and innovate for and guide it onto a prosperous future. At the time, Apple’s financial struggles were plentiful and significant.

Sector Comparison

The third method is the comparison of the company with itself; rather, with its sector or industry. Various sector metrics could be used to determine sector performance and therefore opportunities. In the retail sector, for example, this would include same-store sales growth data, which would help measure a particular company’s success. The company at hand could be compared to other companies in the industry to define its competency.

Economic Moat Analysis

The fourth tool is the consideration of a company’s long-term advantages in the market. These factors, called “economic moats,” imply what will protect the company’s business from competitors and help maintain its advantages. A classic example is Coca-Cola’s brand, which is known throughout the world and benefits from excellent distribution.

Metrics for In-Depth Analysis

In order to conduct a qualitative fundamental analysis, several essential financial metrics are required. As these provide a quantitative measure in terms of a company’s financial status, efficiency, profitability, and market value. Further, each of the defined metrics can provide a breadth of information about the company, which ultimately helps with making proper decisions in terms of investments.

Profitability

Net profit margin, return on assets or short ROA, and return on equity or short ROE are important financial metrics for judging on how effectively a company utilizes its resources to make a profit. For a proper example, while in 2021 Apple Inc. showed up with a total net profit margin of approximately 20%, their ROE or Return on Equity amounted to around 160%. This means that with the help of their shareholders’ equity, they were able to make a 160% profit.

Liquidity

Current and quick ratios help to measure a company’s ability to meet or cover their short-term liabilities with their most liquid assets. For example, suppose a company’s current ratio is less than 1. In that case, it is a red flag as such a company may be likely to experience liquidity issues, which may not necessarily be beneficial for their current or future investors . In addition, suppose a company belongs to the retail sector, and their current ratio equals 0.5. This would mean that the company struggles to handle their short-term liabilities and by extension is unable to turn substantial resources or inventory into liquid assets.

Leverage

Debt-to-equity and interest coverage ratios provide an understanding of how much debt a company is holding and their ability to meet interest payments. A high debt to equity ratio means that the company cannot handle another economic downturn in the industry well because the risk is already high. At the same time, as a proper example, Tesla successfully managed its debts as its debt-to-equity ratio improved from approximately 2.14 in 2017 to around 0.5 in 2022.

Determining a Stock’s Fair Pric

The central part of fundamental analysis is determining the stock’s fair price. This can be achieved by applying a variety of financial metrics, economic factors, and industry activity to assess what a stock’s price should be based on its current and future earnings .

Discounted Cash Flow Method

Perhaps, the most widely used approach to estimate the intrinsic value of a stock is the Discounted Cash Flow DCF method. In this method, analysts predict the company’s free cash flows for some years into the future and then discount back these cash flows to present value using a required rate of return. Assume that Netflix is expected to generate increasing free cash flows for the next 10 years due to the ever-growing number of its subscribers. At the same time, the cash flows will start reducing aft late in the future due to the market saturation. To evaluate the net present value of the company’s current activities, the DCF would measure today’s reversion value of these cash flows.

Price/Earnings Ratio P/E

Basically, the Price/Earnings ratio is one of the simplest measures used by numerous investors for determining whether the stock is overvalued or, vice versa, undervalued relative to historical activity or compared to its industry. For example, the technology industry’s average P/E might be equal to 25. If the P/E ratio of the leading tech company from an elite list is less than 25, this stock may be undervalued, and this might be a great buying opportunity.

Price/Book Value P/B

In 2011, Zhang suggested that the Price/Book, or P/B, “compares a company’s market value to its book, or accounting, value” . P/B can be believed to show if a stock appears to be too expensive relative to what the assets could be selling for on the market. Besides, like the P/E ratio, the P/B ratio is especially helpful for businesses with substantial physical assets. Manufacturing in particular, has important P/B which can show the level of undervaluation.

Long-term Investment Decisions

Long-term investment decisions are among the most important in building wealth through stock market investing. These decisions should be based on a profound understanding of whether a company has potential to keep its business and further grow it in many, many years to come. However, in order to base this decision on something other than a mere guess, a number of tools should be in place, and fundamental analysis, or the focus on the financial health, competitive advantages and the general market potential of a given company, offers just this toolset.

Identifying Sustainable Competitive Advantages

One of the crucial aspects of long-term investments is the ability of a given company to offer sustainable competitive advantages, sometimes referred to as an “economic moat.” For instance, Disney’s ability to create compelling content and strong intellectual property in the form of various franchises is its best economic moat protecting its position in the entertainment industry. However, in and of themselves, these competitive advantages should not merely exist but actively shield the company’s long-term earnings from similarly positioned competitors.

Assessing Management Quality

Management is important for long-term investments as sound leadership can both sheath the company in times of economic declines and fuel its abilities to use long-term growth opportunities. For instance, Tim Cook has, after the death of Steve Jobs, managed to keep Apple on the same streak of innovation and market dominance that defined the company’s presence decades before, making it a sound long-term investment prospect.

Financial Health

This is another crucial aspect of making long-term investments. A company should be in a solid financial position at the time the investment is being made and sustain this throughout the course of holding the security. A sound balance sheet, thus, is a crucial long-term investment condition.

Influences on the Firm

Of course, for very long-term investment decisions, one should also consider medium-to-long-term influences on the firm, e.g. technological or environmental, for example. Considering such trends is important in choosing a proper sector for a long-term investment, and the rise of Tesla alongside the rise of electric vehicle market is a prime example of an ability to spot this trend ahead of time.